Desperate Cubans are going to extraordinary lengths to receive remittances from abroad to circumvent the country’s banking blockade, turning to bitcoin (BTC), middlemen who take commissions of up to 25% and bicycle deliveries as economic sanctions continue to bite.

These were the findings of a report from news agency AFP (via Peruvian newspaper Gestión).

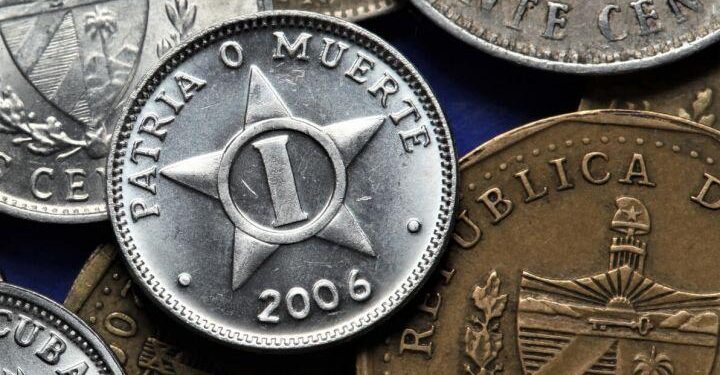

The nation has spent 58 years under economic blockade after the USA first imposed sanctions on Cuba back in 1962, but overseas Cubans continue to look for ways to circumvent banks in their quest to send money home, with most major financial institutions in the world wary of doing any sort of business with the nation. Stripe, PayPal, Visa and other wire and e-pay services do not offer services for Cuban nationals based in their home countries.

In 2017 alone overseas Cubans sent USD 3.5bn worth of remittances to the island state.

The media agency reported that a bitcoin-powered remittance platform named Bitremesas has become increasingly popular in the country.

This involves family and friends based overseas sending BTC via the platform. But rather than send them to their families – often unbanked and illiterate in all things crypto-related – middlemen instead bid for the right to “deliver” these remittances in person.

This involves “converting” the BTC remittances to fiat and delivering them in person to their intended recipients – often by bicycle in 14km journeys through the unforgiving Cuban heat.

The prizes are lucrative, however. AFP stated that Bitremesas middlemen can make “up to 25%” in commission from the deals, in effect bagging a quarter of all the BTC sent.

The news agency quoted a freelancing Bitremesas middleman as stating that “unofficial calculations” have estimated that a 10,000-strong community of Cubans make use of bitcoin, particularly for remittance-related purposes.